How to Graduate Debt-Free

Are you thinking about starting school to prepare for your future career but not sure if you can afford it? Or are you considering changing careers or advancing your career but have financial concerns about student loan debt?

Student debt is a real concern. According to the Education Data Initiative, student loan debt totaled $1.773 trillion in 2024, with the average amount of student debt (both federal and private) up to $41,618.

But don’t stress out! There are ways to potentially graduate debt-free.

Be Proactive

To graduate debt-free, you will need to do some research upfront about the schools that you are interested in and the program costs for coursework and training. Then you will need to plan for the added program training expenses in your budget.

- Think about whether you want to enroll in a certificate course, diploma program, or degree program. The type of program you choose will make a difference in affordability and may impact if you can graduate debt-free. Typically, degree programs are the most expensive.

- Seek out affordable programs in your career area of interest that offer financial assistance or payment plan options.

- See if scholarships or sponsorship programs are available to you, and meet with your prospective school’s financial aid office if applicable.

- If you are currently employed, check with your employer to see if they offer a tuition reimbursement or partial reimbursement program.

- Consider the expenses associated with the program training of your choice. You need to look at all possible expenses, including textbooks, other training materials, computer or other technological equipment needs, certification exam fees, and any additional fees (for example, application or transcript processing fees). Leland, a college and career-coaching organization, notes that students must not only consider the tuition cost but should also consider the other expenditures that must be planned for ahead of time.

- Take into account the length of time to complete the program; requirements to enroll; aspects of career advancement and professional influence; and salary and job opportunities. It’s important to know which type of program will work best for you.

Doing this research in advance will help you make a plan to graduate debt-free and achieve your career goals.

Blackstone Career Institute (BCI), a distance education career training school, offers a variety of certificate courses and diploma programs that can generally be completed in under one year.

BCI offers an alternative education pathway with online, affordable career programs so that students can graduate debt-free and prepare for entry-level careers. Monthly payment options are available with a low-down payment.

Additionally, BCI provides a pay-as-you-progress model that allows students to access units as they make their payments. Tuition is reasonable so students can pay for their education without taking out a loan. Of course, to graduate, the student account balance must be paid in full.

Tips to Graduate Debt-free

- Create a budget to know what the program will actually cost, including all expenses related to the program. Having a budget will help you on your way to graduating debt-free.

- If you are an active member of the Army, check out financial assistance available through the Army Credentialing Opportunities On-Line (COOL) The program is available to active-duty soldiers in the Army to obtain certifications or licenses in career fields. BCI is a leader in online education and is an approved Army COOL program provider. BCI has also been named a Military Friendly® school which means the school offers programs and support to the military and veterans to enhance the workforce.

- Explore the Military Spouse Career Advancement Account (MyCAA) This scholarship is available to spouses of active-duty military members to obtain certifications, licenses, or associate degrees in fields such as healthcare, legal and dentistry, or to continue their education.

- Check out student discounts in the community. These are often offered for events, restaurants, theaters, museums, etc.

- Consider an online certificate course. Training online will eliminate additional transportation and fuel needs and may allow you to work at your own pace. Also, certificate courses require a relatively shorter time commitment (sometimes months) than diploma or degree programs.

- Look into attaining a nationally recognized professional certification. Certification could open up more career opportunities for you. Your future employer may even require it. Consider enrolling in a certification aligned career training program. These programs are typically longer than certificates but shorter than degrees. The program issues you a certificate when you complete the required coursework, but you will need to pass a certification exam given by the certifying organization in your chosen career to earn your certification.

With careful planning and research, you can potentially graduate debt-free. Look into scholarships and other possible funding options and create a budget to manage any additional costs.

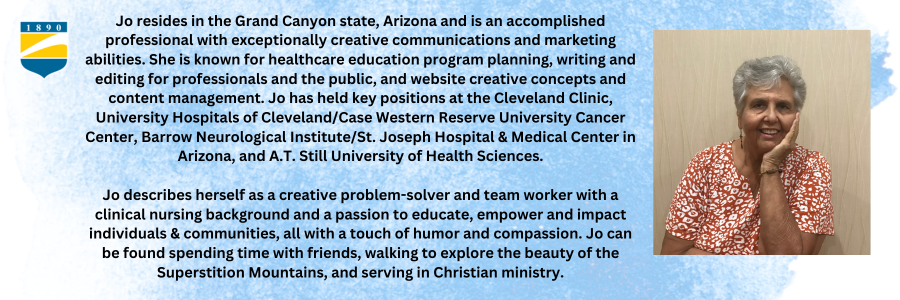

Written by Jo Gambosi